Backgroud:

Today we have fetched serveral symbol from our SmartGo Platform and took research for each of them. We will share you Daily Watchlist you need to pay attentions recently.

SmartGo Watchlist:

✨ 1: UMA

UMA's optimistic oracle is a decentralized truth machine. The oracle can verify any statement proposed on the blockchain. It provides real world data so smart contracts and markets asking for that data can be settled.

The project consists of the following major components working in conjunction:

Optimistic Oracle (OO): UMA's Optimistic Oracle allows contracts to request and receive information. The OO provides that "real-world" data optimistically, which means that data is accepted as true unless anyone disputes the information.

Data Verification Mechanism (DVM): If a dispute is raised, a request is sent to the Data Verification Mechanism (DVM). Disputes sent to the DVM will be resolved after 48 hours after UMA token holders have voted to validate the off-chain data.

UMA is the native token of the project. The current use cases for UMA include:

Security: the token provides economic guarantees to protocols using UMA’s OO, including projects like Across, Polymarket and Sherlock.

Dispute Resolution: UMA’s community of ±token holders provide the human component, as voters, for the OO's final resolution on disputes or queries.

Governance: tokens are also used to vote on protocol upgrades and UMA DAO funds allocations.

On January 27, 2023, the maximum and total token supply of UMA token is 108,858,567. The current circulating supply is 68,947,415 (68% of the total token supply).

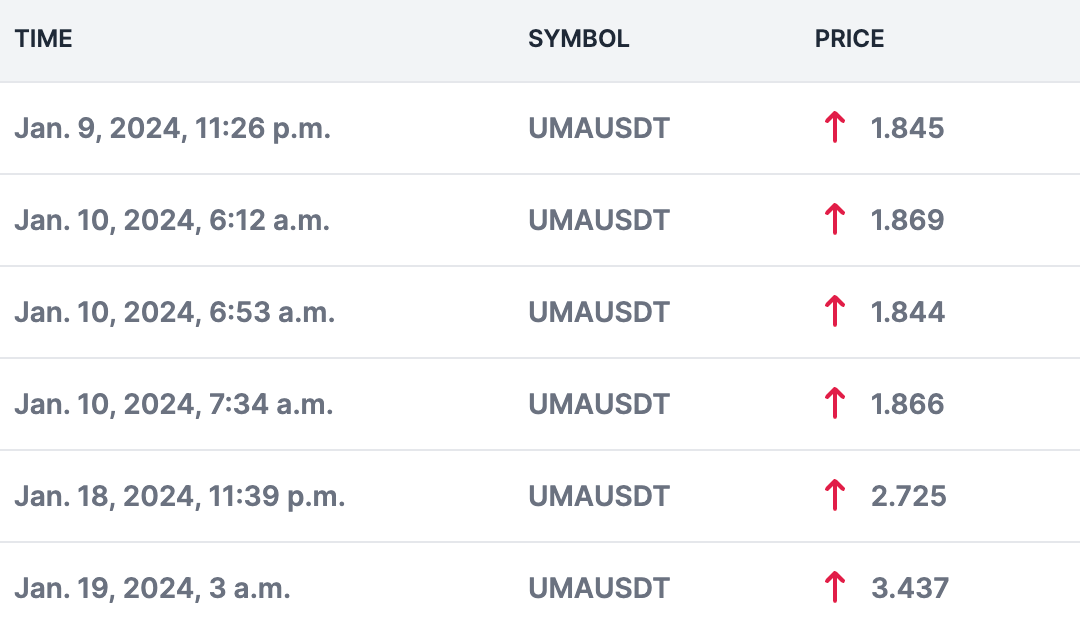

SmartGo Hint: Alert volume volatile at 2024-1-9 at $1.84 and UMA twitter is hosting the “Cracking the eggs event“, let’s see what it will go. some of our VIP members already bought UMA at $2.06 avg price, so it’s 300%+ profit now.

✨ 2: Cartesi (CTSI)

Cartesi is an app-specific rollup protocol with a virtual machine that runs Linux distributions. Cartesi Rollups can be deployed as a layer 2 (on top of Ethereum), as a layer 3 (on top of Optimism, Arbitrum, zkEVM chains, etc.), or as sovereign rollups.

Cartesi brings developers beyond the limitations imposed by EVM runtimes in shared computational environments, opening up the design space for decentralized applications that were not possible before.

CTSI holders can stake their tokens to participate in the ecosystem’s community-driven governance mechanisms. To learn more, visit the Cartesi Governance Page.

Cartesi is designed as an Optimistic Rollups framework embedding its own non-EVM virtual machine.

Cartesi gives each DApp its own rollup with a dedicated CPU, bringing significant gains in computational scalability without compromising decentralization, security, or censorship resistance.

Cartesi Rollups support a VM with a RISC-V architecture, making it possible to boot Linux or other mature operating systems. Developers can bring their ideas to life through rich code libraries, programming languages, and open-source tooling.

As of July 25, 2023, the total and max supply of CTSI is 1,000,000,000, and the circulating supply is currently 742,552,410 (~74.25%).

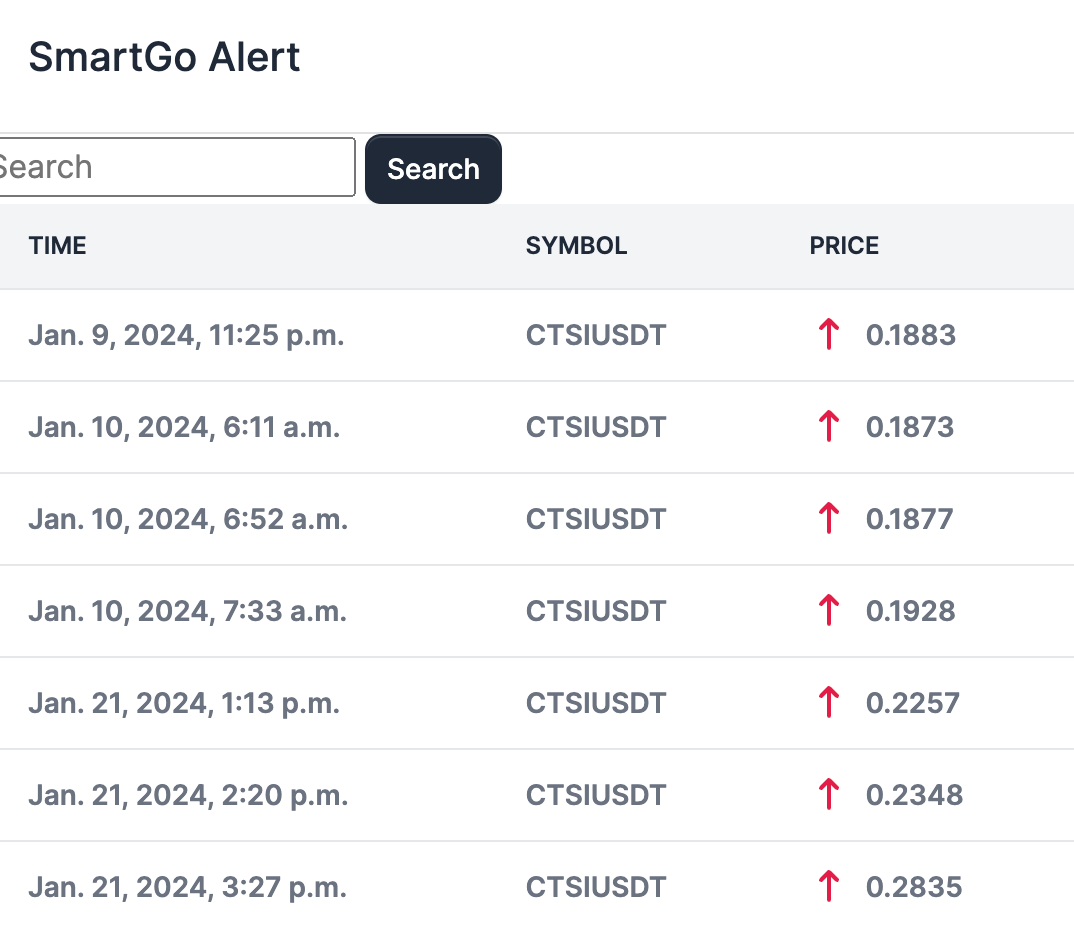

SmartGo Hint: Alert volume volatile at 2024-1-9 at $0.1883 some of our VIP members already bought CTSI at $0.19 avg price, so it’s 77%+ profit now.

CTSI ERC-20 already occur a unusual TX record and they are hosting the honeypot event to let users to test the security of their Rollup, let’s see how it will moves in the coming days.

The content in this Article is for informational purposes only and you should not make investment decisions based solely on it. This episode is not investment advice. You need always to do your own research and take the responsibility on your own investment!

Follow GoWeb3 to get latest news in Web3 World, join the SmartGo VIP for the most porwerful money maker machine, you will 100% no regret to join: